how to take an owner's draw in quickbooks

Visit the Lists option from the main menu followed by Chart of Accounts. Owners Draw on Self Employed QB.

Learn About Making Purchases For Jobs In Quickbooks Pro 2014 At Www Teachucomp Com A Clip From Mastering Quickbo Quickbooks Quickbooks Tutorial Quickbooks Pro

Owners draws are usually taken from your owners equity account.

. Expenses VendorsSuppliers Choose New. Ad Master Invoicing Payroll Inventory Taxes More - Start Today. Select Lists menu option.

A draw lowers the owners equity in the business. If your business is formed as a C Corporation or an S Corporation you will most likely receive a paycheck just like you did when you were employed by someone else. Click on the Banking and you need to select Write Cheques.

Now hit on the Chart of Accounts option and click new. Set up and Process an Owners Draw Account. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

Enter Owner Draws as the account name and click OK 5. Press the CTRL A on your keyboard. To create an Equity account.

From the Account Type drop-down choose Equity. Select the Equity account option. A clip from Mastering.

In the Account field be sure to select Owners equity you created. Select Chart of Account under. Navigate to the Account Type drop-down and select the Equity tab.

Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. You have to select the Account. Click the Banking option on the menu bar at the.

Business owners might use a draw for compensation versus paying themselves a salary. Smith Draws Post checks to draw account. This product is designed to track business income and expenses to.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. In fact the best recommended practice is to create an owners draw. Select Equity and Continue.

2 Create an equity account and categorize as Owners Draw. From the Detail Type drop-down choose Owners Equity. We also show how to record both contributions of capita.

Enter the total amount in the Amount column. To write a check from an owners equity account. Select the Owners Equity and.

To open an owners draw account follow the following steps. Select Print later if you want to print the check. Select the Gear icon at the top and then select Chart of Accounts.

In QuickBooks Desktop software. Choose the bank account where your money will be withdrawn. Here are few steps given to set up the owners draw in QuickBooks Online.

In the Write Checks window go to the Pay to the order of section select the owner and enter an amount next to the sign. Setting Up an Owners Draw. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

A members draw also known as an owners draw or a partners draw is a quickbooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the balance of the owners equity. Go to Banking and select Write Checks. An alternative to recording a payment in quickbooks is to create a journal entry.

Fill in the check fields. In the window of write the cheques you need to go to the Pay to the order section as a next step. Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch.

Now you need to choose the owner and enter an amount next to the currency sign. In the Chart of Accounts window select New. Further click on the Chart of Accounts from the menu.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. When entering a check written to the owner for personal expenses post the check to her draw. Write a Check to Fund Petty Cash or a Cash Drawer.

An owner of a C corporation may not. Then click on the New option from the menu on the bottom left. First of all login to the QuickBooks account and go to Owners draw account.

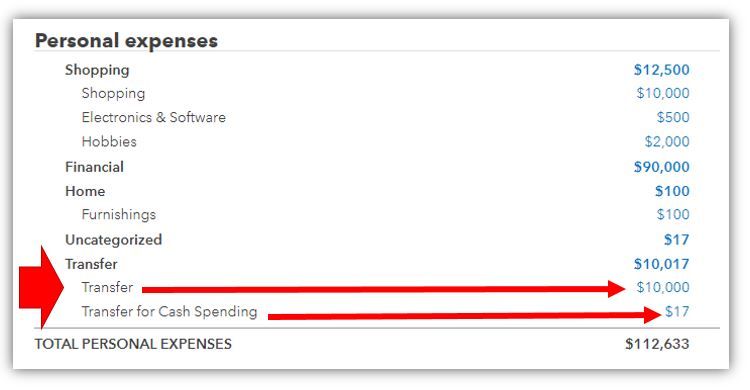

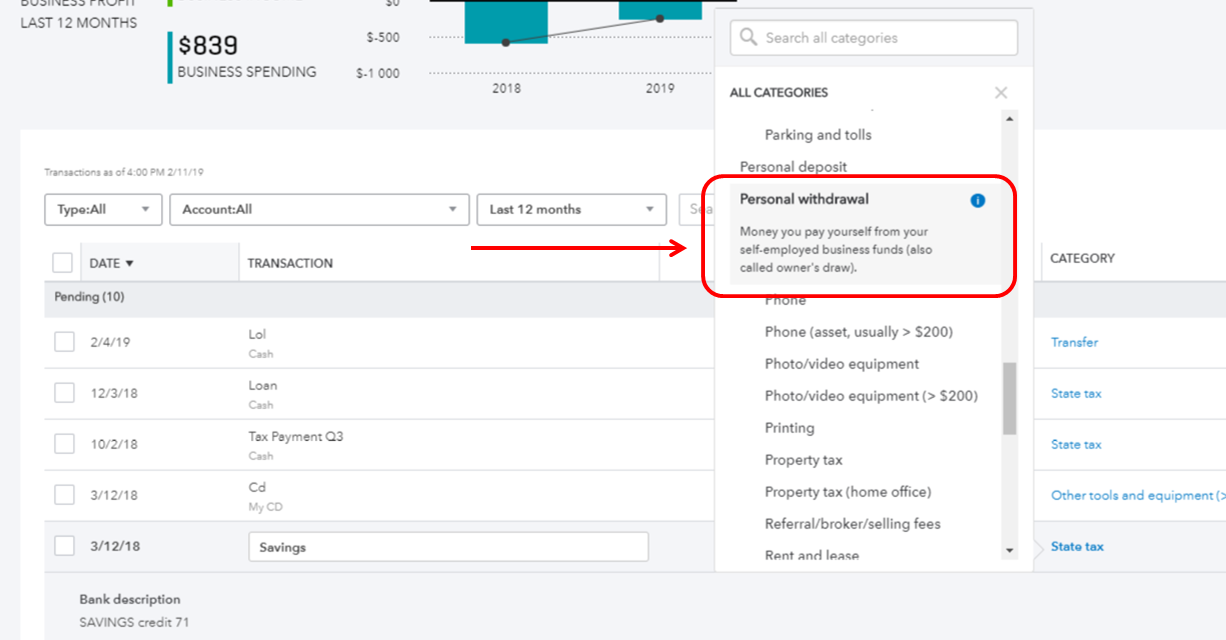

QuickBooks Self-Employed QBSE does not have a Chart of Accounts where you can set up equity accounts unlike QBO. The memo field is optional. In the detail area of the check assign the amount of the check to the equity account you created to record the owners draws.

An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw. An owner can take up to 100 of the owners equity as a draw. Select the business account used to fund the purchase.

At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New. Select the Expenses tab and click the Account drop-down list. Click Save Close to record the check.

Enter and save the information. Owners equity is made up of different funds including money youve. From an accounting standpoint owners draws are shown in the equity portion of the balance sheet as a reduction to the owners capital account.

The information contained in this article is not tax or legal. However the more an owner takes the fewer funds the business has to operate. An owners draw also called a draw is when a business owner takes funds out of their business for personal use.

A clip from Ma. Click Chart of Accounts and click Add 3. Click Save Close References.

1 Create each owner or partner as a VendorSupplier. Open the QuickBooks Online application and click on the Gear sign. However the more an owner takes the fewer.

Quickbooks Owner Draws Contributions Youtube

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Solved Owner S Draw On Self Employed Qb

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

How To Pay Invoices Using Owner S Draw

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

How Do I Pay Myself Owner Draw Using Direct Deposi

Ianywhere Saclrclassloader Has Stopped Working Quickbooks Smb New Names

Solved Owner S Draw On Self Employed Qb

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

How To Change Customer To Vendor In Quickbooks Quickbooks Change Vendor

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

How Can I Run An Owners Draw Report To See The T

Owners Draw Setup Quickbooks Create Setting Up Owner S Draw Account Qb